0 percent desire bank card: You can make desire-free of charge purchases over the advertising APR period of time – generally amongst twelve and 24 months. You should definitely pay out the harmony in total just before it expires, even though, or curiosity will begin to accrue and become additional towards the excellent balance.

Even though regular lenders often prioritise credit history scores, those giving compact cash loans generally undertake a far more accommodating stance, potentially enabling you to definitely accessibility cash now and pay out it later.

The 6 very best purchase now, pay out later apps: Pay back that big invest in eventually What is the greatest get now, fork out later app? Affirm is our favourite because it provides versatile repayment phrases: you may buy purchases in four installments or finance it (credit rating acceptance wanted) for for a longer period repayment conditions.

Some applications report on-time payments to the credit rating bureaus, but others don’t. So, your credit wellness might not enjoy the benefits Even when you make well timed payments or pay the mortgage early.

The platform fees the 1st installment to the borrower’s card immediately after buy authorization or transport after which you can costs the cardboard every month until finally the top with the payment strategy.

One distinction between the two is the fact that buy now, spend later applications typically don't cost interest. Also, you don't have to qualify with a really hard credit score Verify like you should using a credit card.

Stop by our authors web site to satisfy Savvy's expert producing staff, committed to offering insightful and fascinating content that can assist you make informed money decisions.

Plus, it’s reasonably very simple to apply, and you also’ll know quickly for those who’re authorized, combined with the payment system terms. A further significant perk is a large number of apps don’t carry out a hard credit Check out – which could lessen your credit score – whenever you apply.

Affirm delivers large financing limits and is obtainable at an array of retailers, that makes the System a practical choice for big buys.

Cash now, fork out later is a variety of borrowing income on the internet that offers smaller loans and simplified documentation treatments. Your application might get rejected as a consequence of rigid policies and terms when you borrow dollars from standard players.

No credit score Examine or reporting — Afterpay doesn’t execute any credit inquiries, and it doesn’t report your payments to any credit history bureaus. Which means a late payment gained’t be reported and harm your credit rating. But Conversely, making on-time payments received’t support boost your credit.

You've in all probability by now heard of (and will currently use) PayPal, but you won't have recognised that they supply a get now, spend later selection.

Cash now fork out later helps you to borrow revenue for your quick use, including Assembly personalized bills, fiscal emergencies, spending a large hospital bill, and get cash now pay later so on. Quite a few on the net revenue lenders enable you to borrow dollars at zero or very low curiosity prices to repay The cash in equivalent installments.

Deposit — Affirm might demand a deposit in the event you don’t qualify for the personal loan that covers the total Charge of your obtain.

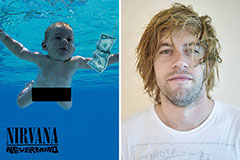

Spencer Elden Then & Now!

Spencer Elden Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Anthony Michael Hall Then & Now!

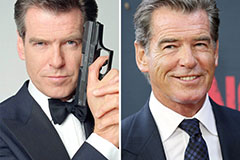

Anthony Michael Hall Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!